by PJN Tax Solutions | Sep 10, 2024 | Uncategorized

If you’ve ever tried reaching the IRS by phone, you’re familiar with the seemingly endless wait times and multiple transfers that often lead to frustration. Now, imagine trying to negotiate your tax debt under these conditions—without a clear understanding of your...

by PJN Tax Solutions | Aug 27, 2024 | Uncategorized

Looming tax debt can be overwhelming and intimidating. Not only does it continue to grow over time the longer it goes unpaid, it can feel like a constant uphill battle. At times, you may wonder what options you have to finally tackle the growing debt, but figuring out...

by PJN Tax Solutions | Aug 13, 2024 | Uncategorized

Filing tax returns is a legal obligation for anyone and everyone earning an income above a certain amount in the United States. But life can sometimes throw you curveballs, and filing taxes ends up being on the bottom of your to do list. Out of sight, out of mind,...

by PJN Tax Solutions | Jul 24, 2024 | Uncategorized

In times of economic hardship, navigating tax obligations can make financial stress so much worse. Sometimes it may be due to being out of work, unexpected medical expenses, or other financial setbacks, and individuals may find it challenging to meet their tax...

by PJN Tax Solutions | Jul 10, 2024 | Uncategorized

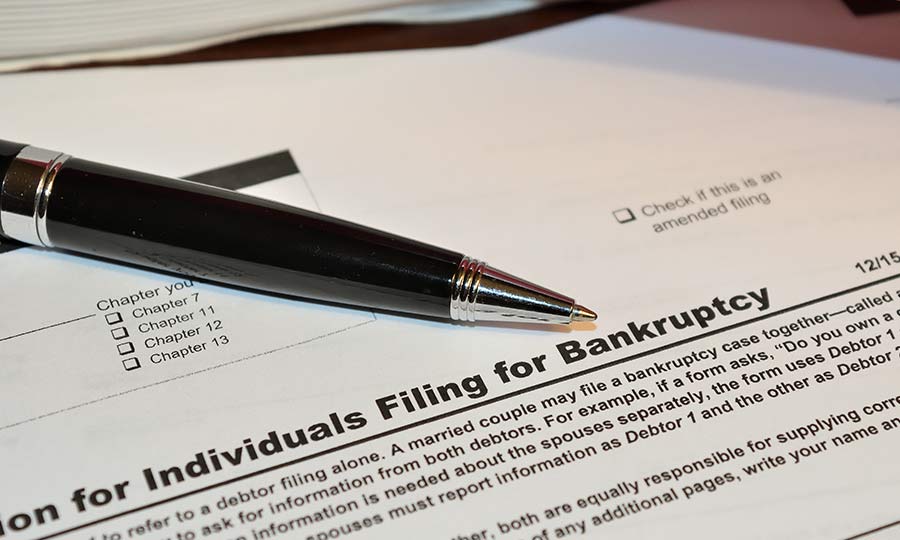

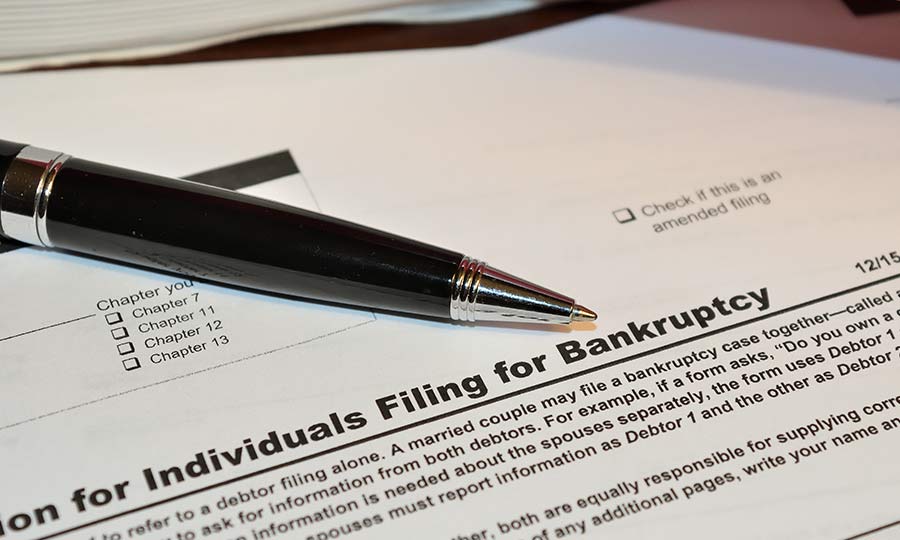

The amount of stress you face when you owe a significant amount of money to the IRS can feel insurmountable. Penalties and interest keep adding on to the debt, and it can feel like there’s often no way out. Oftentimes, people will consider bankruptcy as their only...